How the Rich Are Robbing Puerto Ricans of Their Homes and Communities

The Act 22 tax incentive, enacted in 2012, has been the most effective tool to attract rich outsiders to the island, while local Puerto Ricans are losing their homes and neighborhoods.

Puerto Rico has long been a tropical paradise for Americans seeking a tax haven. However, this has come at a cost to local Puerto Rican communities. The Act 22 tax incentive, enacted in 2012, has been the most effective tool to attract rich outsiders to the island, while local Puerto Ricans are losing their homes and neighborhoods.

Under Act 22, wealthy individuals, including crypto investors and other wealthy outsiders, can avoid most US and Puerto Rico taxes by moving to the island, buying a home, and living for part of the year there. This has led to an influx of Americans seeking to take advantage of the tax breaks, pricing out long-time residents and driving up housing costs. Puerto Ricans are losing their homes, and their neighborhoods are being transformed into enclaves for the rich.

This situation is not typical gentrification, but rather a form of colonialism. Puerto Rico is a US colony, and as such, its people do not enjoy the same benefits as Americans living on the mainland. While Americans can move to Puerto Rico and evade US income taxes, many Puerto Ricans can no longer afford to live on their own island. This is a clear example of how colonialism operates to benefit the colonizer at the expense of the colonized.

According to reports, this tax evasion is depriving these areas of the much-needed tax revenues that fund essential services like healthcare, education, and public safety. The impact of this loss is devastating, particularly for Puerto Ricans who are being displaced from their homeland due to the rising cost of living.

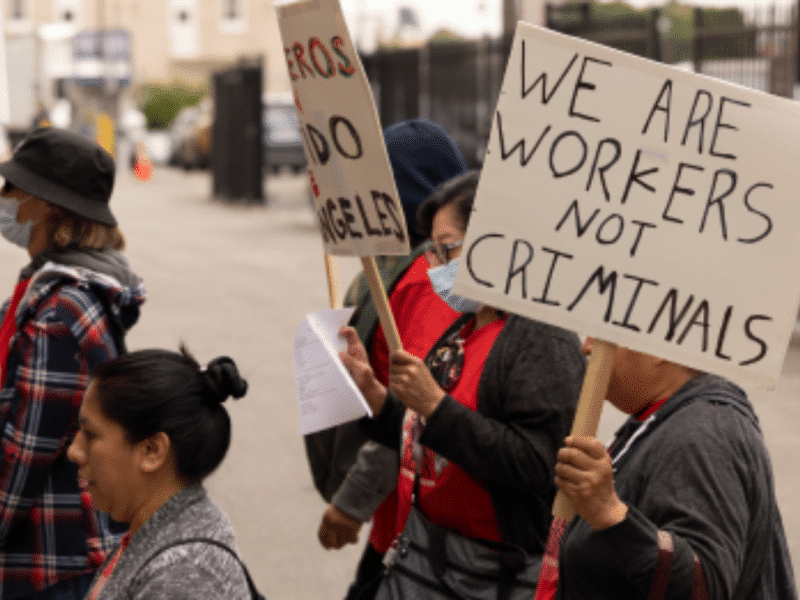

A group of experienced journalists, researchers, filmmakers, and activists has come together to raise awareness about this issue through a media project called Losing Puerto Rico. The aim is to broaden the narratives around the multiple crises facing Puerto Rico and its people, and to invite action from those who have the power to make an immediate change.

Losing Puerto Rico is urging Congress to take action to end the Act 22 loophole and stop rich Americans from moving to Puerto Rico and living tax-free. The collective is calling on concerned citizens to join the cause by signing a petition to demand that Congress takes swift action to address this injustice.

Organizers have set up ways for people to get involved including this petition which calls for Congress to put an end to this demonstrably unfair practice and ensure all individuals, regardless of their wealth, contribute their fair share to support the communities they live in.