These 5 Latinas Are Helping Latinos Tackle the Wealth Gap

In a financial system designed to concentrate wealth in the hands of the few, meet the Latinas who are showing Latinos how to get ahead.

If Latinos in the U.S. were an independent country, their GDP would be 5th in the world, beating the United Kingdom, France, and India. That’s what this study found in 2023, and it speaks to how productive Latinos are in the U.S. That said, the wage gap for Latinos is still a major issue, with them earning 32% less than their white counterparts. Knowing that, it comes as no surprise that the wealth gap between Latino families and white families has surpassed $1 million, according to a recent report from the LA Times.

The Wage Gap

For Latinas, the wage gap is quite concerning. On average, they only make 57 cents for every dollar a man makes. That’s fueled by a combination of factors, including systemic oppression, xenophobia, and the need for greater financial literacy. For many Latinas, this combination of factors has reawakened the effects of the generational trauma that comes from financial hardship.

But in the face of these reports and statistics, there’s a growing group of Latinas making space for themselves and other women of color in the personal finance world. While the financial services industry has historically looked white and male, Latinas are showing up on social media platforms to teach other women how to build wealth not only for themselves but for generations to come.

From investing to eliminating debt, these Latinas are tackling a subject that remains taboo in many Latino families out of fear of being considered greedy or too ambitious. Here are five Latinas who are creating financial literacy courses, using social media platforms to connect with their audience, and sharing their own personal finance stories along the way.

Jully-Alma Taveras

Jully-Alma Taveras is the self-described JLo of personal finance. A Dominican raised in New York, Taveras created Investing Latina in 2019 to teach Latinas how to start investing in the stock market. She began investing at age 19, becoming the first person in her family to open a retirement account. Her Youtube channel has nearly 60 videos of free content, including responses to questions that come directly from her followers, and she regularly breaks down complex financial topics into Instagram posts that are easy to understand. As a personal finance expert, she inspires women to spend intentionally and have a minimalist lifestyle so they can invest more. Her focus is on introducing women to investing so they can take their first steps toward financial freedom.

Anna N’Jie-Konte

Anna N’Jie-Konte is a first-generation American of Puerto Rican and Gambian descent. She’s a certified financial planner and fiduciary dedicated to facilitating the economic liberation of people of color. N’Jie-Konte is a native New Yorker who worked in the financial services industry before launching her own firm, Re-Envision Wealth, where she offers wealth management services. She also uses her platform on Instagram to offer insights about finances for small business owners. More recently, she announced “The Financial Powerhouse: The Club,” a no-fluff community for people who want to learn about wealth-building tools and have more in-depth conversations about financial fluency, and more.

Jannese Torres

Jannese Torres is the host of “Yo Quiero Dinero”, a personal finance podcast created for Latinas and people of color. An engineer by day and self-described side hustle guru, she advises Latinas to build multiple streams of income and teaches money-making strategies to help women succeed. Torres, a first-generation Puerto Rican woman, is also a fierce advocate of investing with the goal of early retirement. Her content on Instagram, TikTok, and the podcast addresses topics from tackling debt to estate planning to financial independence and more. Recently, Torres became an author with “Financially Lit!” the ultimate guide for modern Latinas to become financially powerful.

Delyanne Barros

Delyanne Barros went from attorney to money coach, and she’s dedicated to helping investors take the stock market by storm. Barros, who spent her early years in Brazil before growing up as an undocumented immigrant in Miami, first invested about K a few months before the pandemic led to a market crash. She overcame that by growing that amount to over 5K – all while paying off over 0K in student debt. Today, Barros advocates for investing for retirement with low-cost index funds. Her following has increased consistently on TikTok and Instagram, where she regularly shares brief videos and posts explaining the stock market, breaking down investing myths and updating her audience on news that may affect their finances. Barros doesn’t gatekeep her knowledge, offering a free class, Invest for Independence®, to introduce people to the stock market in a way that finally makes sense.

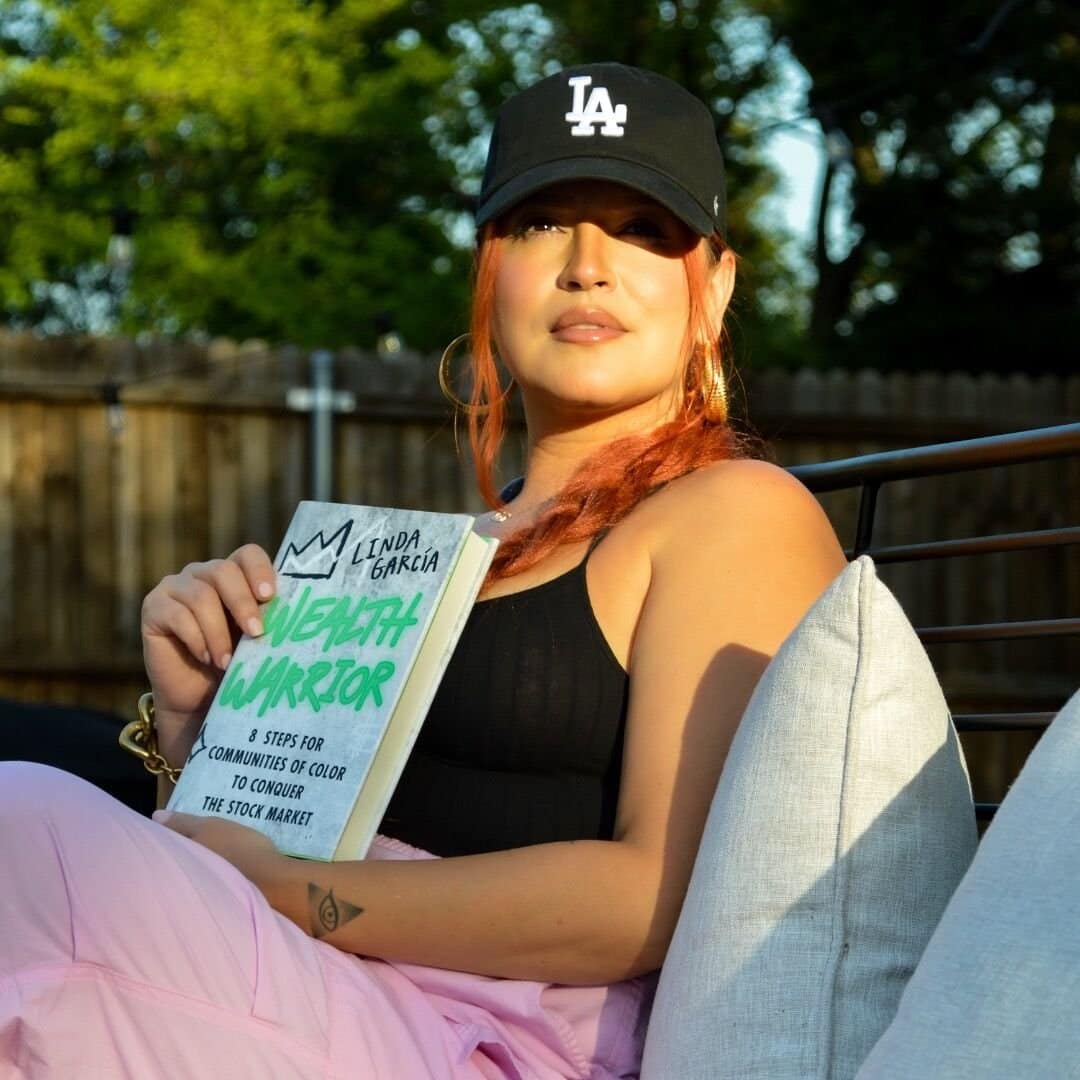

Linda Garcia

Linda Garcia, a Californian with roots in Mexico, began investing several years into her career as a marketing executive in television and film. She’s dedicated to helping the Latino community restructure their generational beliefs on finance and she introduces people to the stock market so they can achieve their dreams. Her “Wealth Warrior” course not only breaks the stock market down but also helps children of immigrants address their toxic relationship with money. Garcia is the founder of In Luz We Trust, an online community where she shares a wealth of resources. She’s also the co-host of the “Investies” podcast, which offers insights into the current stock market and the state of the economy.

These five Latinas are only a few among a growing community focused on creating generational wealth. But this wave of personal finance Latinidad comes at a time when Latinas and Black women across the United States continue making cents on the dollar that white men earn.

Next time you feel anxious about your finances, look them up to learn how to take control of money and heal your relationship with it. And remember – the wage gap that Latinas and other women of color experience can only be narrowed if we talk about money. So let’s build our emergency savings funds, address our debt, and invest in the stock market so we can build the generational wealth that will help our families for years to come.